Big News | Latest news updates from all over the world

W9 Replay: Uncover The Secrets Of Maximizing Tax Savings And Compliance

W9 Replay: Uncover The Secrets Of Maximizing Tax Savings And Compliance is a comprehensive guide that provides in-depth insight into the intricate world of tax compliance and optimization. This essential resource empowers individuals and businesses with the knowledge and strategies to navigate the complex tax landscape, ensuring they maximize their tax savings while maintaining compliance with regulatory requirements.

Editor's Notes: "W9 Replay: Uncover The Secrets Of Maximizing Tax Savings And Compliance" has been published today to address the critical need for accessible and up-to-date information on tax-related matters. In today's dynamic tax environment, understanding the intricacies of tax laws and regulations is paramount for making informed decisions that can significantly impact financial outcomes.

Through extensive research, analysis, and consultation with industry experts, we have meticulously crafted this guide to provide readers with a clear and comprehensive understanding of W9 forms, their purpose, and implications for tax compliance and optimization. By delving into the complexities of tax regulations, we aim to empower individuals and businesses to make informed decisions, minimize their tax liability, and ensure they are meeting all necessary compliance requirements.

Key Differences or Key Takeaways:

| Feature | W9 Replay | Other Resources |

|---|---|---|

| Comprehensiveness | Covers all aspects of W9 forms, tax savings, and compliance | Often limited to specific topics or regulations |

| Expert Insights | Includes insights from industry professionals and tax specialists | May lack expert perspectives or rely on outdated information |

| Practical Guidance | Provides actionable steps and real-world examples | Can be theoretical or lack practical application |

| Up-to-Date Information | Regularly updated to reflect changes in tax laws and regulations | May become outdated or miss critical updates |

Transition to main article topics:

FAQ

This FAQ section provides concise answers to frequently asked questions about maximizing tax savings and compliance with the W9 form. Find practical guidance to ensure accurate reporting and adherence to regulations.

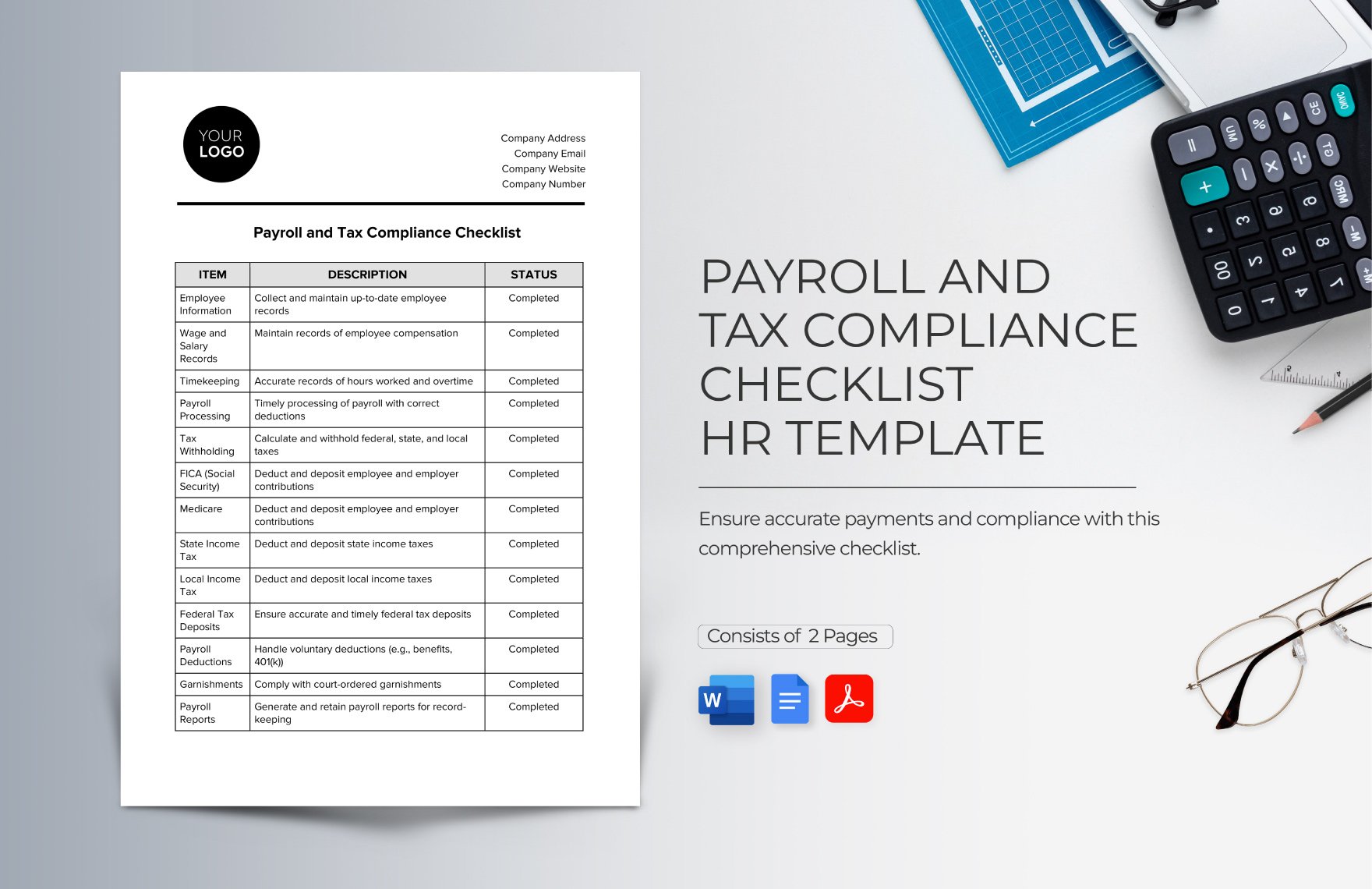

Payroll and Tax Compliance Checklist HR Template in Word, PDF, Google - Source www.template.net

Question 1: What is a W9 form and who needs to file it?

A W9 form, officially known as the "Request for Taxpayer Identification Number and Certification," is used to collect taxpayer information from individuals or entities that receive payments for services rendered. It is primarily used by businesses or individuals making payments to independent contractors or freelancers.

Question 2: What information is included on a W9 form?

The W9 form includes vital information such as the taxpayer's legal name, address, taxpayer identification number (TIN), type of entity, certification, and signature. This information ensures accurate reporting and tax withholding.

Question 3: When is a W9 form required?

A W9 form is required whenever a business or individual makes payments to non-employees totaling $600 or more in a taxable year. Timely submission of the W9 form is crucial for the payer to report the payments accurately and avoid penalties.

Question 4: What are the consequences of not filing a W9 form?

Failure to submit a W9 form can result in backup withholding, where the payer withholds a higher percentage of taxes from the payments made to the payee. Additionally, the payer may face penalties for inaccurate reporting.

Question 5: How can I obtain a W9 form?

W9 forms can be easily obtained from the Internal Revenue Service (IRS) website, downloaded, or requested directly from the payer.

Question 6: What are some best practices for managing W9 forms?

Keep accurate records of all W9 forms received, ensure the information is complete and up-to-date, and securely store the forms for future reference. Regular review of W9 forms helps maintain compliance and avoid potential issues.

By addressing these common questions, we aim to enhance your understanding of W9 forms and empower you to maximize tax savings and ensure compliance. Remember to consult with a tax professional for personalized guidance based on your specific circumstances.

To explore more in-depth insights on tax-related topics, follow the link provided below:

Tips

Maximize tax benefits and ensure compliance with these effective strategies:

Tip 1: Use a Reputable W-9 Request Tool

Streamline W-9 collection with an automated tool that verifies vendors' information, ensuring accurate tax forms and reducing the risk of data errors.

Tip 2: Establish Clear W-9 Collection Processes

Develop standardized procedures for collecting and storing W-9s. Train employees responsible for collecting W-9s to ensure consistency and accuracy.

Tip 3: Track W-9 Expirations

Monitor W-9 expiration dates and proactively request updates from vendors. Staying compliant with W-9 requirements minimizes the risk of penalties.

Tip 4: Scrutinize W-9s for Errors

Thoroughly review W-9s for completeness and accuracy. Identify any missing or incorrect information and request clarifications from vendors.

Tip 5: Utilize Technology for Automated Compliance

Leverage software solutions that automate W-9 collection, tracking, and monitoring. This simplifies compliance efforts and reduces the risk of human error.

Tip 6: Seek Expert Guidance on Complex Issues

When dealing with complex tax or compliance matters, consider seeking guidance from a tax professional or accountant. They can provide tailored advice and help navigate the intricacies of W-9 regulations.

By implementing these practices, businesses can optimize tax savings, maintain compliance, and minimize the risk of penalties. W9 Replay: Uncover The Secrets Of Maximizing Tax Savings And Compliance offers a comprehensive guide to W-9 management, providing valuable insights and best practices for maximizing business outcomes.

W9 Replay: Uncover The Secrets Of Maximizing Tax Savings And Compliance

Navigating the intricacies of tax regulations and maximizing tax savings requires a deep understanding of essential aspects related to W9 forms. This comprehensive guide delves into six key dimensions, empowering taxpayers to optimize their tax strategies and ensure compliance.

- Accurate Identification: Proper identification of independent contractors versus employees is crucial for accurate reporting and tax treatment.

- Timely Issuance: Issuing W9 forms promptly ensures timely and accurate tax reporting by both parties.

- Meticulous Recordkeeping: Maintaining organized records of all W9 forms received and issued is essential for audit preparedness and resolving potential discrepancies.

- Compliance Obligations: Understanding the requirements and responsibilities associated with W9 reporting ensures adherence to tax regulations.

- Potential Penalties: Failure to comply with W9 reporting obligations can result in penalties, highlighting the importance of accuracy and timeliness.

- Tax Savings Optimization: Proper W9 reporting enables taxpayers to claim eligible tax deductions and credits, maximizing their tax savings.

These aspects are interconnected, forming the foundation of effective W9 management. Accurate identification prevents misclassification and ensures appropriate tax treatment. Timely issuance facilitates timely reporting and reduces the risk of errors. Meticulous recordkeeping provides a reliable audit trail and facilitates dispute resolution. Understanding compliance obligations ensures adherence to regulations and avoids penalties. Recognizing potential penalties encourages accuracy and timeliness. Finally, tax savings optimization empowers taxpayers to fully utilize eligible deductions and credits.

Uncover Savings: Top 10 Tax Deductions You May Be Missing #Safe Harbour - Source www.safeharbouraccounting.com

W9 Replay: Uncover The Secrets Of Maximizing Tax Savings And Compliance

The connection between "W9 Replay: Uncover The Secrets Of Maximizing Tax Savings And Compliance" is the use of the W9 form to maximize tax savings and ensure compliance with tax regulations. The W9 form is an IRS document used to collect taxpayer identification information from individuals and businesses. Providing accurate and timely W9 forms to vendors and contractors is essential for businesses to claim tax deductions and avoid penalties. By understanding the importance of W9 forms and how to properly complete and file them, businesses can optimize their tax savings and maintain compliance with tax laws.

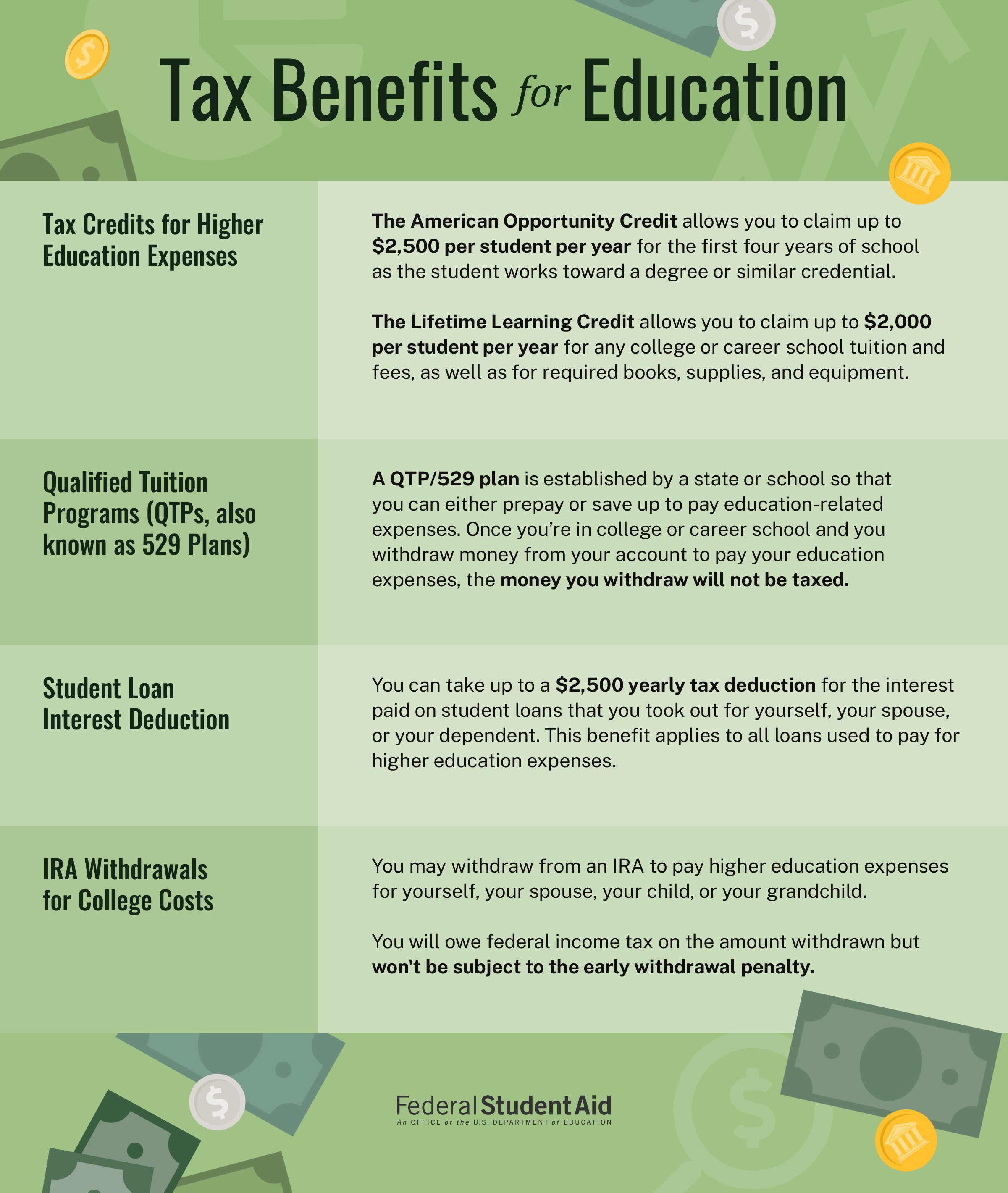

Education Tax Credits: Maximizing Savings With IRS Pub 970, 54% OFF - Source www.micoope.com.gt

The practical significance of maximizing tax savings and compliance includes improved cash flow, reduced tax liabilities, and avoidance of penalties and interest charges. By leveraging the W9 form effectively, businesses can identify and claim all eligible deductions, ensuring accurate tax reporting and reducing their overall tax burden. This optimized tax management enables businesses to allocate resources more efficiently, invest in growth initiatives, and enhance their financial performance.

To further enhance understanding, here's a simplified example illustrating the connection between "W9 Replay: Uncover The Secrets Of Maximizing Tax Savings And Compliance":

| Scenario | W9 Form Impact on Tax Savings |

|---|---|

| Business fails to obtain a valid W9 from a vendor | Unable to claim tax deduction for payments made to the vendor |

| Business obtains an incomplete or inaccurate W9 form | Potential errors in tax calculations, leading to under or overpayment of taxes |

| Business uses W9 form to verify vendor's taxpayer identification number | Ensures accurate tax reporting, avoids penalties, and maximizes tax savings |

By understanding and leveraging the connection between "W9 Replay: Uncover The Secrets Of Maximizing Tax Savings And Compliance," businesses can optimize their tax strategies, improve financial performance, and maintain compliance with tax regulations.