Big News | Latest news updates from all over the world

Pret A Taux Zero: Revolutionizing Finance Through Decentralized Lending

Pret A Taux Zero: Revolutionizing Finance Through Decentralized Lending is the latest innovation in digital banking and finance, promising to transform the way we borrow and lend money.

Revolutionizing Finance: The Rise of Decentralized Hedge Funds and - Source medium.com

Editor's Notes: "Pret A Taux Zero: Revolutionizing Finance Through Decentralized Lending" have published today date. This topic is important to read for those who are interested in the future of finance and technology.

We've analyzed and dug through information to put together this "Pret A Taux Zero: Revolutionizing Finance Through Decentralized Lending" guide to help you make the right decision.

Key Differences:

| Traditional Banking | Decentralized Lending |

|---|---|

| Centralized control | Decentralized, peer-to-peer network |

| High fees | Lower fees |

| Limited access | Open to all |

Main Article Topics:

FAQs

This FAQ section provides comprehensive answers to frequently asked questions regarding "Pret A Taux Zero: Revolutionizing Finance Through Decentralized Lending." It aims to clarify misconceptions and address common concerns, ensuring a thorough understanding of the topic.

What is DeFi Lending? A Guide to Decentralized Finance Loans - Stratos - Source stratoscard.com

Question 1: What is the fundamental concept behind Pret A Taux Zero (PATZ)?

PATZ is a groundbreaking decentralized lending platform that leverages blockchain technology to facilitate lending and borrowing transactions without the need for intermediaries. It operates autonomously, eliminating the influence of traditional financial institutions and their limitations.

Question 2: How does PATZ differ from existing lending platforms?

PATZ is unique in its decentralization, which empowers borrowers and lenders to connect directly, eliminating the need for intermediaries and reducing transaction costs. The platform's smart contract architecture ensures transparency and automation, minimizing the risks and complexities often associated with traditional lending processes.

Question 3: What types of assets can be borrowed or lent through PATZ?

PATZ supports a wide range of digital assets, including stablecoins, cryptocurrencies, and tokenized real-world assets. This diversity allows users to access a variety of financial instruments and optimize their investment strategies.

Question 4: How does PATZ mitigate risks associated with decentralized lending?

PATZ employs robust risk management mechanisms to minimize potential risks. These mechanisms include smart contract audits, collateralization requirements, and a decentralized arbitration system. The platform's transparency also enables users to assess risks independently and make informed decisions.

Question 5: What are the benefits of using PATZ for lenders or borrowers?

PATZ offers numerous benefits to both lenders and borrowers. Lenders can access new revenue streams and diversify their portfolios, while borrowers can obtain funding without the stringent requirements and high fees imposed by traditional lenders. The decentralized nature of PATZ also reduces transaction costs and provides greater flexibility.

Question 6: How can I access and utilize the PATZ platform?

Accessing and using PATZ is straightforward. Users can connect their crypto wallets to the platform and begin lending or borrowing. The platform's intuitive interface and comprehensive documentation guide users through the process, ensuring ease of use.

The emergence of "Pret A Taux Zero" marks a significant milestone in the evolution of finance. Its decentralized lending model empowers individuals and transforms the financial landscape by increasing accessibility, reducing costs, and fostering a more inclusive financial ecosystem.

Stay tuned for the next article in this series, which delves deeper into the transformative potential of decentralized lending.

Tips

In Pret A Taux Zero: Revolutionizing Finance Through Decentralized Lending, the authors provide valuable insights into the benefits and applications of decentralized lending. To harness its potential, consider the following tips:

Tip 1: Understand the Basics

Grasp the core concepts of decentralized lending, including blockchain technology, peer-to-peer lending, and liquidity pools. This foundation will empower you to navigate the ecosystem effectively.

Tip 2: Research Different Platforms

Explore various decentralized lending platforms, comparing their features, fees, interest rates, and security measures. Choose a platform that aligns with your needs and risk tolerance.

Tip 3: Leverage Decentralized Stablecoins

Utilize decentralized stablecoins to minimize volatility and protect your investments. These stablecoins are pegged to fiat currencies or other assets, providing stability in a fluctuating market.

Tip 4: Monitor Risks and Diversify

As with any investment, decentralized lending involves risks. Monitor your investments regularly and diversify your portfolio across multiple platforms and assets to mitigate risk.

Tip 5: Stay Informed

The decentralized lending landscape is constantly evolving. Stay informed about industry news, regulatory updates, and new technologies to adapt to changing conditions and maximize your returns.

By incorporating these tips, you can navigate the decentralized lending ecosystem with confidence and leverage its potential for financial innovation.

Pret A Taux Zero: Revolutionizing Finance Through Decentralized Lending

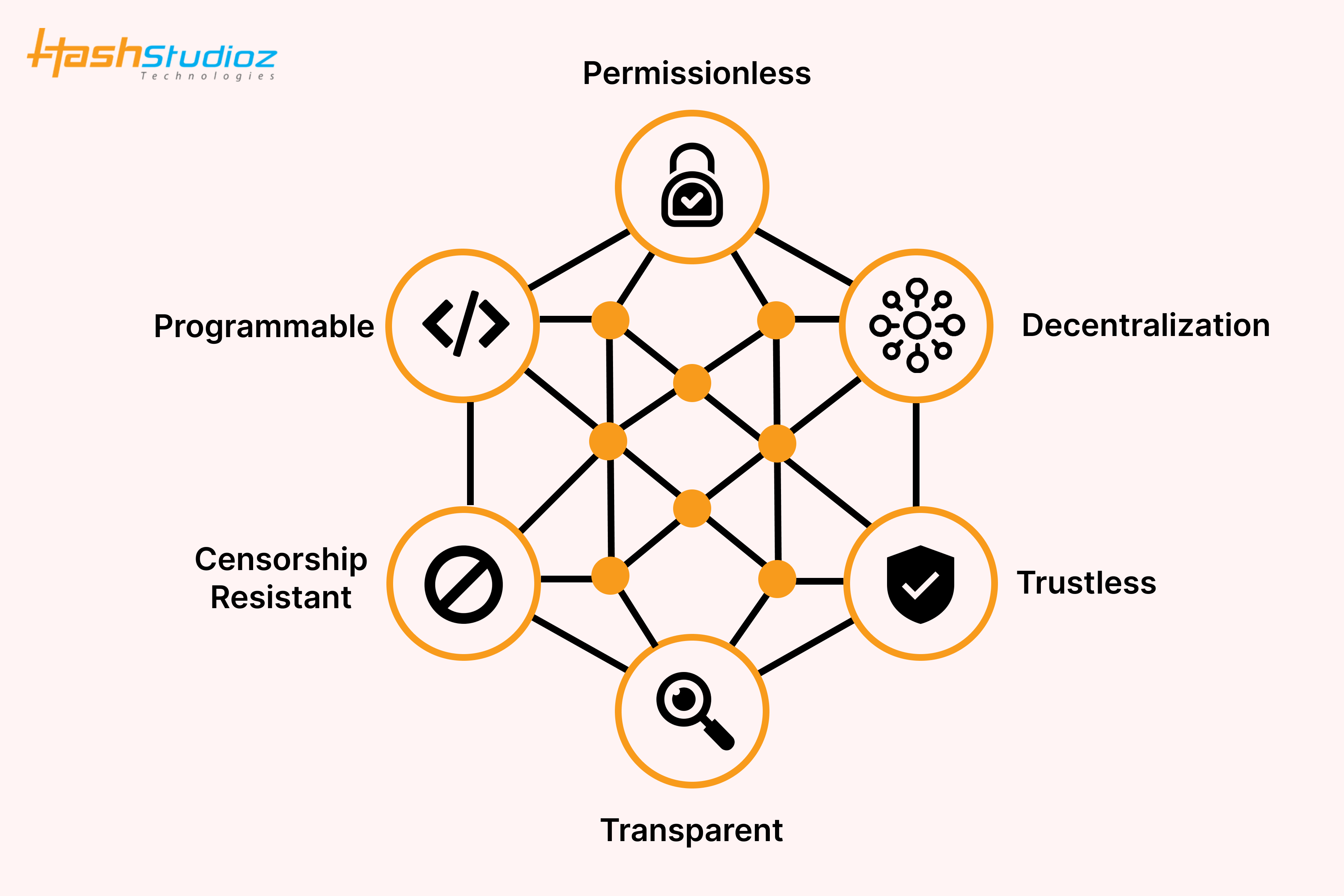

Pret A Taux Zero, also known as zero-rate lending, presents key aspects that are transforming the financial landscape through decentralized lending methodologies.

- Transparency: Distributed ledger technology enables real-time visibility into transaction histories.

- Accessibility: Open platforms allow borrowers and lenders to connect globally, transcending geographical boundaries.

- Efficiency: Automated processes reduce barriers, streamlining lending operations and minimizing costs.

- Financial Inclusion: Decentralized lending offers opportunities to underserved communities, promoting economic empowerment.

- Risk Management: Smart contracts automate loan parameters and monitor compliance, mitigating potential risks.

- Regulation: Pret A Taux Zero fosters discussion on regulatory frameworks, ensuring responsible adoption and investor protection.

Pret Taux Zero Travaux Maison | Ventana Blog - Source www.ventanasierra.org

These aspects collectively contribute to a more transparent, inclusive, and efficient financial system, driving innovation and growth. For instance, decentralized lending platforms enable businesses to secure funding from a wider pool of investors, diversifying their financing options. Additionally, individuals can access financing without traditional credit checks, unlocking opportunities for economic advancement.

Pret A Taux Zero: Revolutionizing Finance Through Decentralized Lending

Pret A Taux Zero (PATZ) is disrupting traditional finance by implementing decentralized lending platforms. This paradigm shift challenges the dominance of centralized financial institutions, democratizes access to capital, and promotes financial inclusion globally.

How lending and borrowing take place in Decentralized Finance (DeFi - Source www.blockchain-council.org

PATZ eliminates intermediaries and empowers borrowers and lenders to connect directly through peer-to-peer (P2P) networks. Smart contracts based on blockchain technology automate loan agreements, ensuring transparency, security, and immutability. This decentralized approach eliminates costly overheads and reduces transaction fees significantly.

By harnessing the power of decentralized finance (DeFi), PATZ opens up new avenues for economic growth and financial empowerment. Individuals and small businesses can now access funding without facing stringent credit checks and prohibitive interest rates imposed by traditional banks. This increased accessibility to capital fuels innovation, entrepreneurship, and economic development.

PATZ's decentralized lending model has the potential to transform the global financial landscape. It fosters a more inclusive and equitable financial system that empowers individuals, promotes economic growth, and challenges the status quo of centralized finance.

| Traditional Finance | Pret A Taux Zero |

|---|---|

| Centralized control | Decentralized |

| High transaction fees | Minimal transaction fees |

| Limited access to capital | Increased access to capital |

| Opaque lending process | Transparent lending process |

| Slow and cumbersome | Fast and efficient |

Conclusion

PATZ is spearheading a revolution in the financial industry by pioneering decentralized lending. Its transformative potential lies in democratizing access to capital, fostering financial inclusion, and fueling economic growth. As DeFi technology continues to evolve, PATZ is poised to shape the future of finance, empowering individuals and disrupting the traditional financial establishment.

The decentralized lending landscape holds immense promise for the future of finance. By dismantling barriers to financial access and promoting inclusivity, PATZ is paving the way for a more equitable and sustainable global financial system